Doing Your Trust With Heritage

Heritage works with hundreds of qualified and licensed independent financial professionals and legal experts in 49 states. At your request we will arrange for one of them to meet with you personally at no additional cost to help you with the preliminary details. They will carefully analyze your needs and arrange to have your Living Trust done. Once you meet with one of our independent professionals, and experience their professionalism, you will understand why Heritage is the place to do your Estate Planning. If you prefer, you always have the option of working directly with our home office. Simply give us a call at 888-437-8778.

The first step is very simple. Take advantage of our telephone or E-mail consultation offer and make your interest known to us. We will help you through the decision-making process, answer all your questions, and instruct you in how to begin your Living Trust.

There is no logical reason for delay. The tragic thing about procrastination is that when you really need a Trust, if you haven't done it... it will be too late to do it. Take care of the important affairs of your estate and save your family from the costs and heartaches of Probate. Send us an email or call us and discuss your concerns. It's free, and we really do want to help.

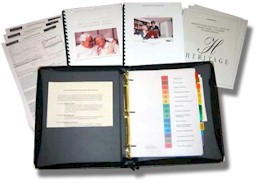

The Documents Provided In A Heritage Living Trust

Introductory Letter With Special Instructions

This document outlines all of the parties to your trust and gives specific instructions on how to execute your Trust.

Abstract or Certificate of Trust

This is a short-form version of your Living Trust document and the one you present if your bank or any other authority asks for a copy of your Trust.

The Living Trust

This is the main Trust document which contains your wishes.

Schedules

This is the document where you list all the assets you want in your Trust. There are provisions for Real Estate and Personal Property.

Personal Property Transfers and Disposition of Personal Effects

This document is where you specify bequests of specific personal property, jewelry, collectables, family heirlooms, pets, etc.

Amendments to the Trust

This document allows you to make changes in your Trust yourself. Simply note the desired change, then initial, date, and notarize, and it's done.

Assets Durable Power of Attorney

This document allows the person you appoint to function in your place in matters of business when you are unable to.

Pour Over Wills

This document directs all assets inadvertently left outside the Trust to be "poured over" into the Trust once they have cleared Probate. This assures only one channel of distribution for your assets.

Living Wills

This document instructs attending physicians regarding the ending of your life if you are in a coma and irreversibly terminal or brain-dead. Choices in levels of care are provided for.

Durable Power of Attorney for Health Care

This document allows you to appoint a person to make health care decisions for you when you are incapacitated and unable to make those decisions for yourself.

Burial Instructions

This document allows you to determine and record your decisions regarding your burial or cremation.

Instructions Regarding Donation of Anatomical Gifts

This document allows you to give or deny permission and specify details regarding the donation of vital organs or your entire body.

Settler Trustee Instructions

This section contains complete instructions for the settlement of your estate. Your appointed successor trustees can successfully close your estate by following these instructions.

Essential Documents Location

This set of documents allows you to record details of your life and location of important papers as well as key advisors you depended on such as your pastor, attorney, accountant, etc.

Last Instructions To Your Family

This section allows you to write a final private communication to your family and hold it in confidence until your death.

Appointment of Guardian for Minors

This document allows you to assign a legal guardian for your minor children or disabled adult dependent children.

Appointment of Conservator

This document allows you to assign a "Conservator of the Person" for yourself in the event you become permanently incapacitated through illness, accident, or old age, avoiding the need for a court-appointed Conservatorship.

Separate Property Agreements (A-B Trust Only)

These documents allow you to legally define sole and separate property between spouses, especially in community-property states.

How You Are Charged

Finally, our pricing structure is unique. Unlike most attorneys who do Living Trusts, we do not use the clock as a determiner of cost. Our program is priced on an all-inclusive single price for the entire project. There are no hidden fees or hourly charges for follow-up work.

The price is the same for a small estate or a large estate up to the current Estate Tax Exemption (for married couples). In 2021 the Estate Tax Exemption is $11.7 million for individuals and $23.4 million for married couples. For estates of married couples above the Estate Tax Exemption we recommend the use of a Q-TIP Living Trust in order to protect your excess (above your marital Estate Tax exemption) assets for your surviving spouse. If you have a special needs child, our special needs trust provisions will preserve any public assistance your child my be receiving while allowing you to provide ancillary support for your child's uncovered needs and pleasures. Modest fees would be added for these provisions but disclosed to you in advance.

The following services are included:

- The Complete Trust package containing about 18 documents for a Marital Trust

- Second copies of all Powers of Attorney and Living Will for your Successor Trustee(s).

- Our book, "The Living Trust Companion".

- Free reasonable changes, as necessary, for the life of your Trust.

- Free drafting of Quit Claim Deeds for transfer of real property into the Trust.

- Free ongoing support service by E-mail and telephone at no extra cost.

- Please contact Heritage Living Trust at 888-437-8778 or your local Heritage Independent Agent for cost information.

The only additional charges you would incur are the Notary fees you pay for signing your Trust, and any filing fees that would be necessary when you file your property deeds into the Trust at your county recorder's office. The Living Trust itself should never be filed.

Although many attorneys advertise a low price for drafting the Trust documents, they typically do not include in their price the process of funding the Trust. Instead, they charge you their going rate of $250 to $300 per hour to help you fund your assets into it (transfer deeds, savings accounts, investments, and the like). It isn't unusual for the total cost with an attorney to add up to $2,500 to $4,000 by the time your Living Trust project is completed and funded even though the attorney may have advertised or quoted a low initial price. Even then, future help and assistance will most surely be charged to you at the attorney's hourly rate of $250 to $300 an hour. Heritage Trust was formed to offer an alternative to this costly and difficult situation and we never charge for follow up, changes, or funding assistance. As we said, if you work with an attorney make sure he is uniquely qualified and get his services and costs detailed in writing on his letterhead before you start.